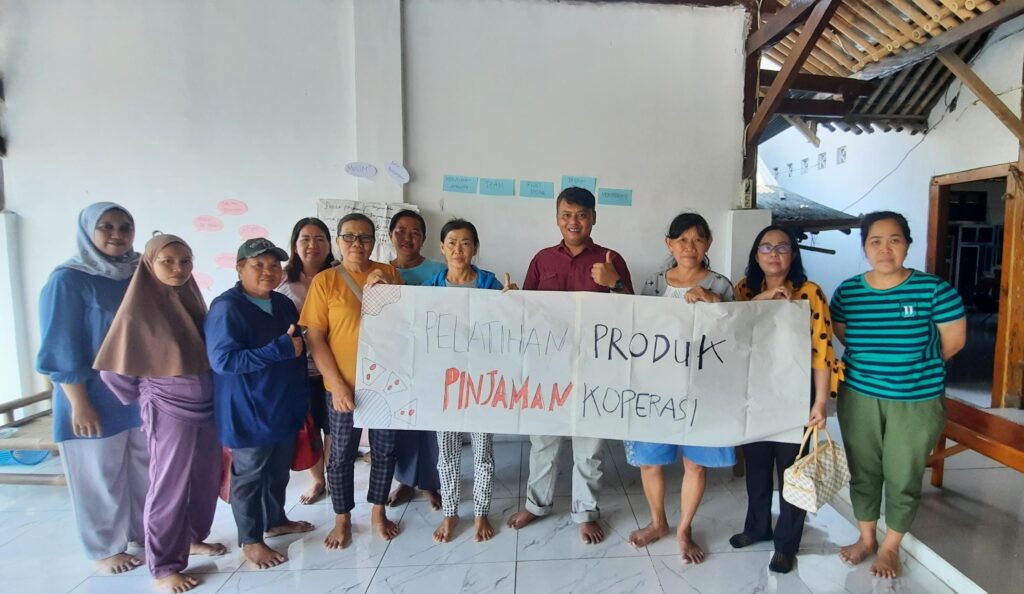

Wednesday, June 19, 2024, a warm and enthusiastic atmosphere filled the hall of Mr. Cuan Hoy's house, RW 01 Belimbing Village. Ten administrators and members of the Lantern Merah Abadi Women's Resource Development Cooperative (KWPS) gathered to attend cooperative loan product training. This training aims to increase the capacity of cooperative administrators and managers in developing products that are relevant and in demand by members and the surrounding community.

This training was guided by two experienced facilitators, Mr. Iqbal Yusti Ekoputro and Mrs. Happy Octa Familia. They delivered various materials on cooperative product development, both savings and loans. In his opening remarks, the facilitator emphasized the importance of a deep understanding of loan products available in cooperatives. As well as how cooperatives can adapt to the diverse needs of their members.

In general, this training aims to strengthen the ability of cooperative administrators in managing cooperative products that are in accordance with the needs of members. Specifically, the objectives of this training include: thoroughly examining savings products and cooperative financial reports. Then, dissecting loan services and cooperative financial reports, providing an understanding of the product development process. As well as explaining the benefits of product development analysis, and Exploring Loan Products: Between Opportunities and Challenges.

In the training session, the main focus was given to the loan products offered by the Red Lantern Abadi Cooperative. This cooperative has developed two main types of loan products: general loans and business loans. Each type of loan has different requirements and benefits, tailored to the needs of the cooperative members.

General loans can be applied for by members who have joined the cooperative for at least three months and have initial savings of Rp250,000. This loan can be given in stages, starting from Rp1,000,000 to Rp4,000,000, with the main condition that the installments must be smooth.

On the other hand, business loans are intended for members who already have a business. The amount of business loans can reach Rp50,000,000. With stricter membership requirements to ensure that members who borrow have a clear and sustainable business.

One of the main activities in this training is group discussions. Where participants are asked to evaluate existing loan products and provide input based on their experiences. Mrs. Lanni, who acted as the spokesperson, delivered the results of the group discussions. She noted that the total general loans provided reached Rp115,732,000. While business loans amounted to Rp60,000,000, with 59 general loan borrowers and 6 business loan borrowers.

In the discussion, cooperative members were also invited to understand the importance of adjusting loan products to the needs of members. An example given was in East Jakarta, where many members do not yet have motor vehicles. Cooperatives can create motorcycle loan products that allow members to own motorcycles and pay for them through installments to the cooperative.

Koperasi Lampion Merah Abadi, often faces seasonal challenges. Where demand for loans can increase drastically, especially at certain times such as approaching the new school year or harvest season. Therefore, the cooperative needs to prepare sufficient reserve funds in cash and offer loans to members as an anticipatory step. This is an important strategy to ensure that the cooperative continues to operate smoothly. So that members do not experience difficulties in accessing the services they need.

One of the main objectives of this training is to provide a deeper understanding of the importance of product analysis in cooperative development. Cooperative members are taught how to calculate the percentage of loan applications with disbursements. As well as the importance of being careful in granting loan approvals. Given that closeness or kinship factors are often considerations that can be detrimental to cooperatives in the future.

The facilitator also emphasized the importance of marketing cooperative products through promotional media placed in strategic locations. This step is expected to help spread information about cooperative products to the wider community. Thus increasing the number of members and users of cooperative services.

This cooperative loan product training is not only a learning event. But also a joint reflection on how cooperatives can play a bigger role in improving the welfare of their members. With a better understanding, the Lampion Merah Abadi cooperative is now better prepared to face challenges and take advantage of existing opportunities.

The main challenge for the cooperative in the future is to ensure that the products offered are truly in accordance with the needs of the members. Also easily accessible to all levels of society. With a strong commitment from the management and members, the Eternal Red Lantern Cooperative is expected to continue to grow. Become a solid economic pillar, and provide real benefits to all its members.